${item.excerpt}

Featured in ${item.section}

${item.excerpt}

Featured in ${item.section}

Relying too much on credit such as Buy Now Pay Later and credit cards, particularly on a tight student budget, can be risky. See what steps you can take to tackle your consumer debt.

Having some debt isn't bad if it's kept under control, but it can be tough keeping up with repayments on a student budget. If you're struggling with consumer credit debt like BNPL, credit cards, or personal loans, seek help quickly. Don’t ignore your debt!

This page outlines the steps to take if you are struggling to make your Australian credit repayments, as well as more information specific to the different types of credit products, and some alternatives to using credit while you're a student.

This information is provided by DUSA Financial Wellbeing. Visit the DUSA Financial Wellbeing webpage for more information about this service.

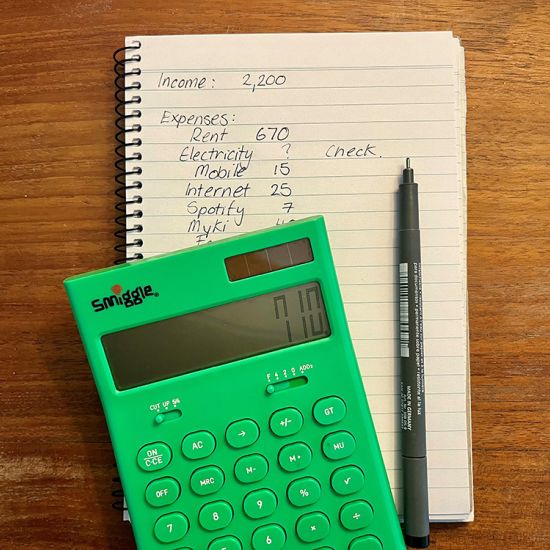

1. Work out what you can afford to pay

2. Contact your provider to let them know you are having trouble paying

3. Request confirmation of any new payment arrangement in writing.

Keep this confirmation for your own records, and as a reminder of the arrangement.

4. If you think you have been treated unfairly you can make a complaint

You can make a complaint to the provider and if you are still unsatisfied you can make a complaint to AFCA, the external dispute authority.

BNPL can seem like an easy way to pay for things, but there are risks – you are borrowing money and you can end up in financial difficulty when you spend and borrow too much or have too many accounts.

BNPL lenders are not regulated under Australian Credit Law, which means that you have less rights and protections. Make sure that you understand the risks of BNPL and consider using other less risky options.

Even if you are up to date with your BNPL payments, having multiple BNPL applications and accounts listed on your credit report can negatively affect your credit rating.

For more information about the risks of BNPL see this National Debt Helpline webpage.

If you are struggling to meet the payments of your BNPL debt, this NDH website gives step by step instructions specific to BNPL products.

Credit cards can be a useful way to pay, and while some people like them for rewards points, it can be a risky choice when making purchases beyond your earnings. The key is to pay the full balance of your credit card on time to avoid interest charges.

If you are struggling with credit card debt, your provider is required by law to consider your request to a change to your repayments based on financial hardship.

For objective information about credit cards, see the credit card section of the MoneySmart website.

If you are struggling with credit card debt, see these instructions on the National Debt Helpline.

Personal loans usually have a lower interest rate than credit cards, but they are still high compared to other types of credit. If you are struggling to make your personal loan repayments, you have legal rights and options. See this information on how to negotiate payment terms on the National Debt Helpline website.

Contact DUSA Financial Wellbeing

If you are struggling with essential living expenses or relying on BNPL or credit cards for essentials, reach out to the the DUSA Financial Wellbeing team to explore safer alternatives. We can work with you to prepare a budget or money plan to help you get your finances under control, provide information about financial grants and emergency relief you may be able to access, and give you practical advice if you have debts.

Save up before making new purchases

If you are using BNPL or a credit card to pay for essential living expenses, see the above alternative. Otherwise, consider creating a separate savings account to save up over time to buy the item once you have the money rather than spending money you don’t have.

We’ve got your back! You have options and there are steps you can take yourself, but if you need more guidance, DUSA Financial Wellbeing are here to help.